OUR BUY NOTHING CHALLENGE: 2014

CONTENTS:

1. Our Rules for 2014

2. Last Minute Buying in 2013

3. Our Garage Sale Addiction

4. Our Allowance Spending First Half of 2014

5. Fall 2014 Spending Update

6. FINAL 2014 THOUGHTS- DID WE SUCCEED?

NOTE: If you haven't seen our main Buy Nothing Challenge page,

you'll want to read it first to understand the what and the why of our Challenge.

you'll want to read it first to understand the what and the why of our Challenge.

1. OUR RULES FOR 2014:

From Theresa:

You might be thinking that buying nothing is impossible in this place at this time, and you would of course be correct. We are not entirely self-sufficient, so we unfortunately do need to buy some things in order to survive. These are things we believe we will still need to spend money on:

Exceptions to the Challenge:

There are also some other purchases that we’re not sure we can realistically avoid in 2014, including:

Theresa mentioned that the Buy Nothing challenge would mean we need to stop going to restaurants or buying prepared food, including at work. However, I talked her into giving me a $2.50/week allowance to buy a morning coffee and a biscuit for my lunch, which I get for a greatly discounted 25 cents each at work.

We decided to buy me a role of quarters every month, so I could make sure I didn’t overspend. But then I remembered that coffee is actually 26 cents, so I’d be short a penny every day, unless I skipped a day and used that extra to make up the difference. Or, if I want a large candy bar, it will cost me four days of no work food, or if I want a shake from Culvers I buy no “work food” for two weeks. Decisions… decisions.

I figured something out… $2.50 a week sucks! I shouldn’t buy even one candy bar. To get a coffee every day I have to skip a biscuit because of the tax (I’m short 1 flippen cent per coffee!). And pretty much anything I am interested in eating will cost me at least 2 to 3 weeks of no coffee. That’s not much of an allowance. However… it does total $130 a year… and that’s $30 more than Theresa gets for plants! Ha!… Bitching done (down to grumbling now).

I also snuck in my demand to give ourselves an allowance for unexpected needs, which we decided would be $300 each for the year, which we can spend no questions asked. We will keep track of our totals on a sheet of paper on the refrigerator.

From Theresa:

I feel like this is a lot of exceptions to our Buy Nothing challenge, but I realize the exceptions make the whole experiment a bit less psychologically daunting for us and perhaps more realistic.

You might be thinking that buying nothing is impossible in this place at this time, and you would of course be correct. We are not entirely self-sufficient, so we unfortunately do need to buy some things in order to survive. These are things we believe we will still need to spend money on:

Exceptions to the Challenge:

- Food & other staples from the grocery store (such as the ingredients we use to make our cleaning supplies)

- Cat needs: food, liter, health supplements, vet visits

- Monthly bills, which for us includes: gas, electricity, water/sewer/garbage, local & long distance phone/internet service, house & car insurance, Netflix, the mortgage, my student loans

- Health Care: health insurance premiums and deductibles, medicines, gym membership, massages

- Gas and car repairs

- Added 1/17/14: bird seed. I have been feeding the birds since the first year she moved in, and Bear has agreed to this expense.

- Added 2/2/14: Theresa's registration fee ($300) to the Midwest Women's Herbal Conference. Bear decided that it was a worthwhile expense.

- Added 2/10/14: hair cuts. I tried to learn to cut my own hair, and realized it is impossible to cut the back myself. Bear also agreed to watch our hairdresser to see if he could learn to cut my hair, but that didn't work. I only get my hair cut 2 or 3 times a year for $15 each time, and Bear probably gets his done about the same if not less, so I don't figure we'd save a lot by doing this ourselves anyway. Although if we could do it ourselves, it would be nice to not have to make an appointment and show up for it.

- Added 2/10/14: Birthday meals out at a restaurant. It seems a reasonable splurge twice a year.

- Added 3/1/14: For his birthday, Bear decided (without consulting me) that he got to ignore the entire challenge for the week (we celebrate our birthdays for an entire week), so we ate out at restaurants several times and he went shopping at used book and video stores for a birthday present for himself.

- Added 4/5/14: An annual pass to Wisconsin's State Parks, for $25. We're allowed to forage for mushrooms, nuts, berries, and fruit on state land, some of which is very near to our home, so we hope to add to our food supplies this year.

- Added 6/1/14: For my week of vacation that I take at the end of May every year to work on our garden, I ended up declaring an exemption to our challenge, much as Bear did during his birthday week, except I bought a lot of plants to fill empty spaces in the garden that were otherwise being overrun by non-edible weeds. It was difficult to keep myself from eating out during vacation, and we spent $60 one one meal that was very disappointing. At at the end of the week I was not very happy because we had to take money out of savings to cover what we bought. As I try to count things up now, we probably spent around $200 that week without really realizing it. But the garden is looking very good. And we are back on course now.

- Added: 6/3/14: $60 to repair our hot water heater, which stopped working. This is a small price compared to replacing it, which is what we were expecting because it is more than 20 years old, but it's still spending money. I couldn't convince Bear that we could experiment with other ways to heat our water.

There are also some other purchases that we’re not sure we can realistically avoid in 2014, including:

- I was supposed to stock up on rechargeable batteries before this challenge started, but was too busy building this website.

- Wood for the wood stove- this usually costs us around $500. Currently we don’t have a chainsaw or a truck with which to cut and haul our own, and no land from which to take it (although I see it offered for free on Craigslist a lot if you can cut & haul it).

- We currently have only one car. Can we find a way for this to work, or will we need to buy a second one?

- A new chair or couch for the TV room- the one Bear sits on is close to collapsing and I am using a rather hard rocking chair that belonged to my grandmother (but I am reminded of the TV show Little House on the Prairie in which Ma Ingall’s rocking chair was the best seat in the house, so maybe I need to reassess).

- New computer equipment- sometimes our second hand computer parts work, sometimes they don’t so much.

Added 3/2/14: we decided that we needed to buy a new computer. Ours has Windows XP, which will no longer be supported after April 8. We checked into whether it could be upgraded to Windows 7, which was possible for a computer tech to do, but not us. Also, Windows 7 would have cost us $300, so we might as well get a new computer for the first time in 25 years, since you can buy one now for $300. The University I work at has a program through which staff can get some discounts, so we're upgrading to a far better computer for only $515. It should make working on this website much, much easier. We also bought a new printer and ink for $185 and an ergonomic keyboard (I have carpal tunnel), for $37. We got a larger used monitor for $40 at a garage sale. - Bear has given me a $100 budget for buying plants for the yard this year. I don’t think this is very generous, since I am trying to change all of our lawn to garden and grow as much edible food as possible, which helps the grocery budget, but since he agreed to this whole scheme, I guess I have to agree to the $100 limit.

2/10/14: Bear changed my budget to $130, to match what he was getting for snacks at work.

Theresa mentioned that the Buy Nothing challenge would mean we need to stop going to restaurants or buying prepared food, including at work. However, I talked her into giving me a $2.50/week allowance to buy a morning coffee and a biscuit for my lunch, which I get for a greatly discounted 25 cents each at work.

We decided to buy me a role of quarters every month, so I could make sure I didn’t overspend. But then I remembered that coffee is actually 26 cents, so I’d be short a penny every day, unless I skipped a day and used that extra to make up the difference. Or, if I want a large candy bar, it will cost me four days of no work food, or if I want a shake from Culvers I buy no “work food” for two weeks. Decisions… decisions.

I figured something out… $2.50 a week sucks! I shouldn’t buy even one candy bar. To get a coffee every day I have to skip a biscuit because of the tax (I’m short 1 flippen cent per coffee!). And pretty much anything I am interested in eating will cost me at least 2 to 3 weeks of no coffee. That’s not much of an allowance. However… it does total $130 a year… and that’s $30 more than Theresa gets for plants! Ha!… Bitching done (down to grumbling now).

I also snuck in my demand to give ourselves an allowance for unexpected needs, which we decided would be $300 each for the year, which we can spend no questions asked. We will keep track of our totals on a sheet of paper on the refrigerator.

From Theresa:

I feel like this is a lot of exceptions to our Buy Nothing challenge, but I realize the exceptions make the whole experiment a bit less psychologically daunting for us and perhaps more realistic.

Ultimately, it’s not really important whether or not we stick to the rules.

It’s what we will learn by trying to stick to them, and what we will learn if we decide to break them, that is important.

Hopefully, we will learn to recognize our cultural training in over-consumption, and learn what it is truly necessary to buy and have.

Hopefully, we will learn more fully that things do not bring happiness.

It’s what we will learn by trying to stick to them, and what we will learn if we decide to break them, that is important.

Hopefully, we will learn to recognize our cultural training in over-consumption, and learn what it is truly necessary to buy and have.

Hopefully, we will learn more fully that things do not bring happiness.

2. Last Minute Buying in 2013

From Theresa:

It was early December when we decided to try the Buy Nothing Challenge (BNC), so that gave us a few weeks for last minute cheating, I mean buying, before the challenge began on Jan. 1st.

Here’s the list of what I thought I needed to buy:

I have a couple observations about this list:

From Bear:

Bear’s self explanatory list:

Also, Bear and Theresa went for one last shopping spree at the used book stores, and they ate at some restaurants for the last time while they were in town.

It was early December when we decided to try the Buy Nothing Challenge (BNC), so that gave us a few weeks for last minute cheating, I mean buying, before the challenge began on Jan. 1st.

Here’s the list of what I thought I needed to buy:

- Clothes: I bought socks and underwear, as well as a couple pair of pants for work.

- Shoes: I didn’t have any shoes that didn’t have holes in them, so I bought a pair of hiking books ($10 used) and a pair of tennis shoes ($55 new).

- Paper: As a writer, I couldn’t imagine being without paper, and my understanding is that making good writing paper is really hard. I bought lined paper for writing, a ream of paper for the printer, and small notepads because we both love making lists.

- Cordless Vacuum Cleaner: Ours recently died. Our only carpeted room is our kitchen (not our choice), so I use one of those small, battery operated sweepers that are sold to people for quick clean-ups. I’m much more likely to take it out than one of those loud, corded monstrosities. I could, of course, just use a broom, which is what I did for a while, but it is much more time consuming. I think I only swept once, when it got really, really bad. To continue with the broom, I would need to modify my standards of cleanliness, which is not necessarily a bad thing. The invention of the vacuum didn’t save time for housewives. It just increased our standards so that now we think the floor should be spotless all the time, and we actually sweep more. I compromise by using a faster, easier vacuum and lowering my standards a bit about the corners of the room.

- Headlamp: I bought one of those battery operated lights that you wear on a strap around your head. I think they are made for bike riders? I have been experimenting with using one instead of turning on lights in the house, as a way to save electricity. I had bought a cheap $4 one, and found that it worked really well to light my morning chores, but it was so cheap that if you bumped it, it turned off. I found a better one at a sporting goods store for $35 (they had them ranging from $25 to over $100). Of course, I should have bought one for Bear, because it’s not helpful if I’m using a head lamp and he turns on the ceiling light.

- Book Light: I also buy these to try and save electricity. We read a lot at the dinner table, so I bought a kind that sits up by itself and lights both the book and the meal. It also creates a good ambiance when reading in front of the wood stove. I talked Bear into getting one too.

- Solar Camp Shower: This is a black plastic bag that holds 5 gallons of water, which is heated by hanging it the sunshine. Last summer I bought one from a garage sale to see if I could save resources by using one in our house. It fell apart on the first try- I’m hoping it was just old. This Winter, I want to try to heat the water by hanging the bag up near the woodstove.

- Tea Strainers: I bought some tea nets/ tea strainers from Mountain Rose Herbs. The ones I bought from them years ago had finally fallen apart and I had been meaning to get some more for a long time. They are a cotton bag hanging from a wire ring that hangs nicely inside a mason jar without falling in and are great for straining herbal infusions. I probably could have made them myself if I took the time.

- Lamp Shades: The ones we had were barely hanging on the lamps and had big tears in them. I bought three used for $1.70 each that work and look great.

- Maple Syrup Making Supplies: I tried to buy some syrup making supplies. Last year we tapped our walnut trees for syrup. We used some plastic buckets to catch the sap, which worked except that they attracted bugs (who drowned in the sweet syrup), and we couldn’t leave them outside during the rain (so missed that day’s worth of sap). So I tried to buy some sap buckets with lids that are specifically made for collecting maple syrup. I find a website that sold used ones (the new ones were too expensive), but the website couldn’t seem to complete my order after repeated tries, so I gave up. My next plan is to see if we can make our own lids.

- Rechargeable Batteries: Last summer I bought a solar charger for batteries, as part of my scheme to lower our electrical usage, but it’s so far sat unused since I haven’t ordered batteries. Bear also wanted me to get batteries for his Wii remote (on which he watches Netflix). I haven’t yet figured out where to buy the long lasting batteries from, though, so didn’t get around to it. Rechargeable batteries from the well-known name brands that you can get in the regular stores don’t hold their charge very well (e.g., the book light I use on my van pool which I ride to work everyday needs recharging once a week vs. when I use non-rechargeable batteries, they last for months). I did add this to our list of exceptions so I could buy them online later when I had time.

I have a couple observations about this list:

- It was nice to know there was an end to it. I’m tired of having to run into town when we need stuff (it’s 30 minutes away since we won’t shop at the nearby super WalMart due to their business practices). I’ve been trying to limit my trips into town with better planning, but often, after I’ve driven into town, they are out of what I need so I have to return another day, or worse, I take it home and it’s defective, so I have to drive all the way back to return it. I knew that this time, if I got everything on my list (and it worked), my in-town shopping trips would be over for a long time.

- As I look at this list, it seems really long. Did I really need all this stuff? I’m looking forward to a year of finding out what I really need. I’m imaging that I would like to be like the pioneers- going to town for supplies only once or twice a year. Time is precious- why spend it shopping?

From Bear:

Bear’s self explanatory list:

- socks

- underwear

- work pants & work boot insoles

Also, Bear and Theresa went for one last shopping spree at the used book stores, and they ate at some restaurants for the last time while they were in town.

3. OUR GARAGE SALE ADDICTION:

From Theresa:

You may remember that one reason we wanted to try our 2014 Buy Nothing Challenge (BNC) is that we felt our spending was getting out of control, even though we already bought most of our stuff used. We wrote that "during garage sale season we still look at shopping as a form of entertainment, and we go a bit crazy impulse buying more than we need (because it only costs $1!). Then some of our new purchases clutter our house for weeks before we find a use or a place for it all.”

This weekend was the Mt. Horeb Village Wide Garage Sale days, which we've been going to for over a decade, and we found that, in spite of our BNC, we couldn't resist going this year either. Even though it's true that we overbuy at garage sales, it is also our only opportunity to get some really useful things at prices we can afford. For us, it’s often either buy it used or we're not able to afford it at all.

So our compromise was this: we would go to the garage sales, but anything we bought would have to come out of our $300 allowances. Since I'm holding tight to what's left of my $300, this made me feel confident that I wouldn't buy anything that I didn't really need, or that at least I wouldn't purchase a lot of unimportant little things that were cheap individually, but added up to a lot of money at the end of the weekend.

Friday

I took Friday off, picked Bear up from work at 1 pm, and we headed to the more than 100 garage sales that were being held in Mt. Horeb. We both realized that we weren’t nearly as excited about it this year since our spending was limited. This year would be more about getting things we needed, which is not as fun as feeling the thrill of impulse buying (why exactly is that thrilling?). We also found that as we drove around town we were much more selective about which sales we were willing to get out of the car for. There is certainly a lot of stuff at garage sales that we do not want and that likely nobody wants, and finding the good stuff is like a treasure hunt. So unlike previous years, we only stopped at sales that looked like they had a lot of stuff to choose from, and that weren’t the houses that held a sale every year (how much good stuff can they have to get rid of year after year?). Bear says that after working 8 hours (and because of the BNC restrictions) the sale had to look very interesting for him to drag his tired butt out of the car.

You may remember that one reason we wanted to try our 2014 Buy Nothing Challenge (BNC) is that we felt our spending was getting out of control, even though we already bought most of our stuff used. We wrote that "during garage sale season we still look at shopping as a form of entertainment, and we go a bit crazy impulse buying more than we need (because it only costs $1!). Then some of our new purchases clutter our house for weeks before we find a use or a place for it all.”

This weekend was the Mt. Horeb Village Wide Garage Sale days, which we've been going to for over a decade, and we found that, in spite of our BNC, we couldn't resist going this year either. Even though it's true that we overbuy at garage sales, it is also our only opportunity to get some really useful things at prices we can afford. For us, it’s often either buy it used or we're not able to afford it at all.

So our compromise was this: we would go to the garage sales, but anything we bought would have to come out of our $300 allowances. Since I'm holding tight to what's left of my $300, this made me feel confident that I wouldn't buy anything that I didn't really need, or that at least I wouldn't purchase a lot of unimportant little things that were cheap individually, but added up to a lot of money at the end of the weekend.

Friday

I took Friday off, picked Bear up from work at 1 pm, and we headed to the more than 100 garage sales that were being held in Mt. Horeb. We both realized that we weren’t nearly as excited about it this year since our spending was limited. This year would be more about getting things we needed, which is not as fun as feeling the thrill of impulse buying (why exactly is that thrilling?). We also found that as we drove around town we were much more selective about which sales we were willing to get out of the car for. There is certainly a lot of stuff at garage sales that we do not want and that likely nobody wants, and finding the good stuff is like a treasure hunt. So unlike previous years, we only stopped at sales that looked like they had a lot of stuff to choose from, and that weren’t the houses that held a sale every year (how much good stuff can they have to get rid of year after year?). Bear says that after working 8 hours (and because of the BNC restrictions) the sale had to look very interesting for him to drag his tired butt out of the car.

|

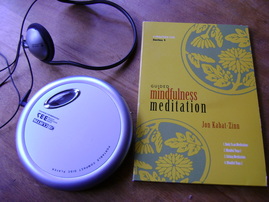

Friday Purchases:

Nesting glass mixing bowls with plastic lids (Somehow we broke all our mixing bowls this year. These are $25 new) $8 Futon chair bed (for unfurnished attic room) $20 Hot dogs, treats (I was too busy gardening in the AM, so didn’t take time to eat lunch) $7.25 Down pillow (Bear's pillows were losing feathers at an alarming rate) $5 Four Guided Meditation CDs (I am trying to meditate more) $1 A book on making Chicago Style pizza $1 Bear bought 12 Ultimate Fighting Championship DVDs $12 |

Friday Total for Theresa: $20.75 Friday Total for Bear: $33.50

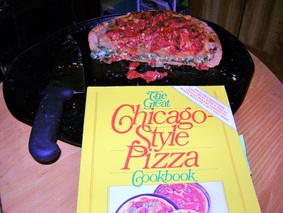

Our Chicago style stuffed pizza.

Our Chicago style stuffed pizza.

We were both pretty happy at the end of the day Friday. We hadn’t spent too much, but we had both found something that gave us that triumphant consumer feeling that we had hunted and gathered successfully. For Bear, this was his DVDs that he couldn't find anywhere else for $1. He was done shopping for the weekend.

For me, it was the pizza book. Even though it was only $1, I did debate with myself about whether or not I needed it. I was introduced to this particular style of pizza when I went to college in Chicago. We thought we were in heaven if we could afford to buy a stuffed pizza on the weekend. I’d unsuccessfully tried making it myself before, and the book had procedures I hadn't tried, so I got it. To prove to myself further that it was not a wasted purchase, I went home that night and made a stuffed pizza. It did not taste like I remembered from college, but it was the closest I'd come so far, and I can work on adjusting the flavor to match what I remember.

For me, it was the pizza book. Even though it was only $1, I did debate with myself about whether or not I needed it. I was introduced to this particular style of pizza when I went to college in Chicago. We thought we were in heaven if we could afford to buy a stuffed pizza on the weekend. I’d unsuccessfully tried making it myself before, and the book had procedures I hadn't tried, so I got it. To prove to myself further that it was not a wasted purchase, I went home that night and made a stuffed pizza. It did not taste like I remembered from college, but it was the closest I'd come so far, and I can work on adjusting the flavor to match what I remember.

Saturday

We weren’t supposed to go to garage sales on Saturday, but I managed to talk myself (and Bear) into it. It was supposed to rain on Sunday, so I planned to stay home and garden on Saturday. But there was a really chill breeze in the morning, and I was really tired because the cats had woken me up early, so I convinced myself I should wait until the afternoon, when it would be warmer, to work in the yard. After all our analyzing of reasons to go or not go to garage sales, I remembered that last year during garage sale weekends I had bought a weather station that we had never installed. I pulled it out and found that I needed some pvc and lithium batteries to install it. This necessitated going to the hardware store in Mt. Horeb, so naturally I decided we might as well stop at some garage sales at the same time. So I used this as an excuse to wake up Bear (at 9 am), and we were off again.

Bear here: What Theresa didn't know was that I was watching dumb but entertaining videos on YouTube Friday night and didn't fall asleep until after 3 am. So... on little sleep I could choose to do garden work in the cold or drive around and treasure hunt most of the morning. I would rather drive around, but I coudn't really build up too much enthusiasm about shopping because I already got what I wanted on Friday (those DVDs).

Saturday there were a lot of "might be useful later" opportunities I passed up because I did not want to use up my $300 allowance. Chances are I will find a use for the stuff I didn't buy and kick myself later. For now, I'm not kicking myself because this is how a lot of money gets wasted without really understanding it's been wasted.

Bear's question: There's so much stuff that could be useful at garage sales that is easy to store, it's hard to resist buying it. But is it frugal to buy something you might use because it's cheap now, or is it more frugal to not buy it and take a chance of having to pay full price for it it when you need it in the future?

We weren’t supposed to go to garage sales on Saturday, but I managed to talk myself (and Bear) into it. It was supposed to rain on Sunday, so I planned to stay home and garden on Saturday. But there was a really chill breeze in the morning, and I was really tired because the cats had woken me up early, so I convinced myself I should wait until the afternoon, when it would be warmer, to work in the yard. After all our analyzing of reasons to go or not go to garage sales, I remembered that last year during garage sale weekends I had bought a weather station that we had never installed. I pulled it out and found that I needed some pvc and lithium batteries to install it. This necessitated going to the hardware store in Mt. Horeb, so naturally I decided we might as well stop at some garage sales at the same time. So I used this as an excuse to wake up Bear (at 9 am), and we were off again.

Bear here: What Theresa didn't know was that I was watching dumb but entertaining videos on YouTube Friday night and didn't fall asleep until after 3 am. So... on little sleep I could choose to do garden work in the cold or drive around and treasure hunt most of the morning. I would rather drive around, but I coudn't really build up too much enthusiasm about shopping because I already got what I wanted on Friday (those DVDs).

Saturday there were a lot of "might be useful later" opportunities I passed up because I did not want to use up my $300 allowance. Chances are I will find a use for the stuff I didn't buy and kick myself later. For now, I'm not kicking myself because this is how a lot of money gets wasted without really understanding it's been wasted.

Bear's question: There's so much stuff that could be useful at garage sales that is easy to store, it's hard to resist buying it. But is it frugal to buy something you might use because it's cheap now, or is it more frugal to not buy it and take a chance of having to pay full price for it it when you need it in the future?

|

Saturday Purchases

cutting board, sketch pad, notebook with lined paper, bamboo garden stakes, sturdy small cheese grater, broiling pan, shelf liner $4 netting- possible use for new catio, if not, can use as garden trellis $1 alarm clock designed so that when the cat sits on it the time does not change itself $.50 fencing, artwork for new catio, box of wood screws, bird house in good shape, PVC for weather station, 3 prong electric cord $8 snacks $.50 pressure cooker $5 large gallon jar for pantry storage $.25 a better feather pillow $3 foam wedge for leg elevation during sleep $1 portable CD player so I can listen to the meditation CDs I bought yesterday during my commute to work $1.50 Saturday Total: $12.40 each GRAND TOTAL SPENT BY BOTH OF US BOTH DAYS: $79.50 |

From Theresa: Overall, I don't feel bad about our garage sale weekend. I don't think we bought so much this time that it won't get put to use- I did sleep on the futon chair last night and am already learning how to use the pressure cooker. And we got some amazing deals, which is ultimately the reason we garage sale. I did some quick checking online to see how much we probably saved.

|

These were our best bargains:

T-fal Calipso stainless steel pressure cooker for $5 is selling for $80 on Ebay- or if you buy a new one of this quality it looks like they’re well over $100. The person selling this said he got it from a garage sale, but had never used it. I also have a very old aluminum one from a garage sale I’ve never used because I can’t figure out how to cook safely with it. But this one looked newer and appeared to have the safety features I've read about. I was able to get a manual for it from this website: hippressurecooking.com. The website also seems to have a lot of information about why pressure cookers are so great, how to use them, and recipes. I've been wanting to try a pressure cooker because it cooks so much faster. Dry beans that take 1 1/2 hours on the stove cook in less than 30 minutes in a pressure cooker. It may revolutionize the way I cook with bulk items from my pantry. And because it cooks so much faster, it saves resources. Futon bed chair, cushion and wood frame, for $20- I had trouble finding a price for this online- similar ones were in Euros, which converted to between $100-$200. We've put this in our somewhat unfinished attic retreat room. We currently have no comfortable seating there, nor any beds. The futon chair will help me be able to take retreats before we get around to completing the renovations. Keyboard arm tray for $15- would be at least $100 new. This will bring the keyboard to the right height to be ergonomically correct for me, which will help the pain I have in my shoulders, arms, and wrists when I type too much. I’m cheating and calling this computer equipment, which is part of our list of exceptions, so it doesn’t have to come out of my $300. (Follow-up note from 1/2015:

I find it interesting to note what has become of these "bargains:"

|

Greg Garious here (Bear's alter-bargain hunting-ego): You can't save money in stores by asking, "Can you do any better on this?" or "What's the best you can do on this?" but at garage sales you can get away with it. Bartering can be fun. It's nice to find bargain prices on items I'm looking for: what are $6 DVDs in the resale store I find for $1. Theresa tells me that I should mention that I am totally shameless when it comes to bartering and will make outrageously underpriced offers on anything, which people are willing to take. Even if something is priced really cheap at a garage sale, you can often make an offer for less and still take your find home. People often seem to be happy just to be rid of it, at any price. Theresa is sometimes embarrassed by my ultra-bargaining- to which I say "Wah."

Greg was very subdued this year because of not wanting more crap around the house and the BNC, but he did have business cards for our website to hand out, so got to use his gregarious super powers to chat without being greedy.

Greg was very subdued this year because of not wanting more crap around the house and the BNC, but he did have business cards for our website to hand out, so got to use his gregarious super powers to chat without being greedy.

Why Garage Sales Can Be Good

From Theresa: Village wide garage sales are wonderful places to shop for deals if you don’t get out of control. Obviously, you can save a lot of money and buy things that are in perfect or near-perfect condition, and often still in the unopened original box. Each town in our area holds theirs on a specific weekend each summer (see their village or chamber of commerce websites for dates).

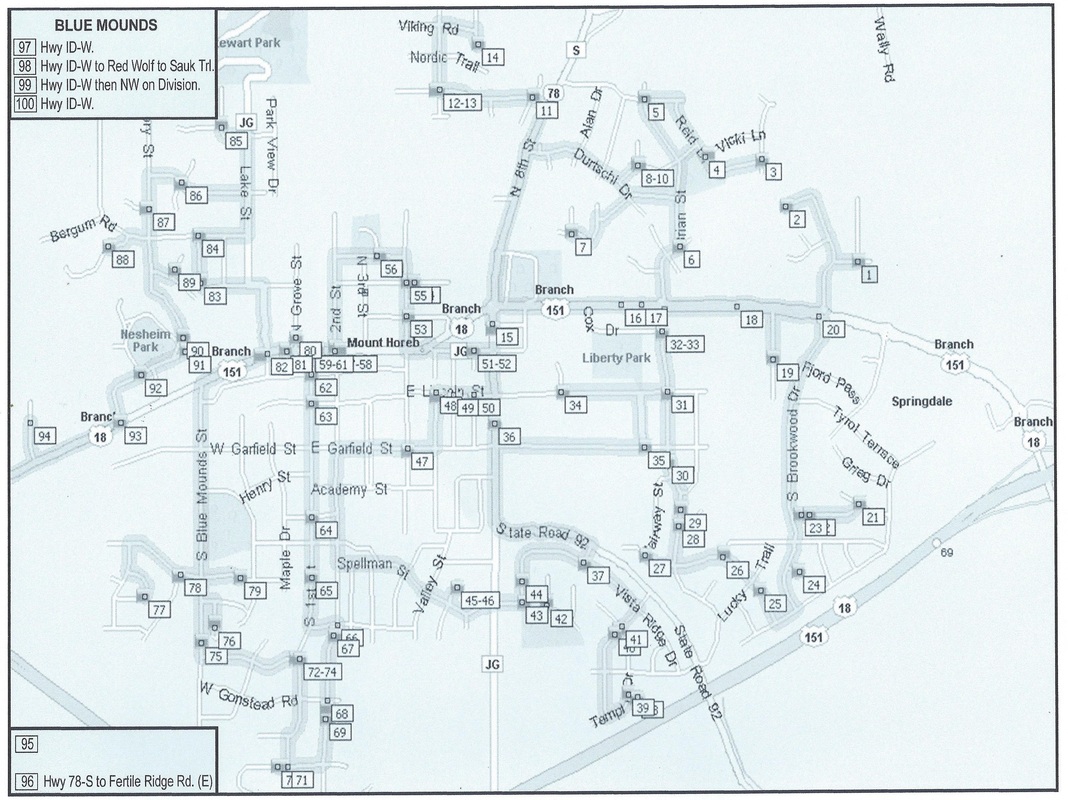

We met someone this weekend from Arizona who was quite amazed at the village wide phenomena and wondered if it was a Mid-West thing. She seemed very excited, but also overwhelmed by the opportunity. There are so many sales taking place at a time that there are often several near each other on a street so you can park and walk to them. It’s sort of the used shopper’s version of a mall. Here's the map of the 100 official sales in Mt. Horeb (with a few in nearby Blue Mounds), and there are many more unofficial ones not listed:

From Theresa: Village wide garage sales are wonderful places to shop for deals if you don’t get out of control. Obviously, you can save a lot of money and buy things that are in perfect or near-perfect condition, and often still in the unopened original box. Each town in our area holds theirs on a specific weekend each summer (see their village or chamber of commerce websites for dates).

We met someone this weekend from Arizona who was quite amazed at the village wide phenomena and wondered if it was a Mid-West thing. She seemed very excited, but also overwhelmed by the opportunity. There are so many sales taking place at a time that there are often several near each other on a street so you can park and walk to them. It’s sort of the used shopper’s version of a mall. Here's the map of the 100 official sales in Mt. Horeb (with a few in nearby Blue Mounds), and there are many more unofficial ones not listed:

I also think of garage sales as our culture’s system of wealth redistribution, like a potlatch, if you’re familiar with that cultural anthropology concept. It’s the richer people who have amassed more goods than they can use, redistributing their wealth by making it available to those of us who can’t buy it in the real mall.

Some people might find shopping for used items beneath them, but I’m good with it. I'd rather other people's unwanted items end up in my house than in the garbage. It's a great form of recycling.

Bear notes that garage sales are also good because it gives our cats new stuff to sniff.

Our Conclusion

Like many things, garage sales are good in moderation. We got some great deals, and we didn't use up the $300 allowance we each have for the year. Here's where we currently stand with our Buy Nothing Challenge- the year is more than one third over and we've spent:

Theresa $ 117.40

Bear $ 145.53

Like many things, garage sales are good in moderation. We got some great deals, and we didn't use up the $300 allowance we each have for the year. Here's where we currently stand with our Buy Nothing Challenge- the year is more than one third over and we've spent:

Theresa $ 117.40

Bear $ 145.53

4. Our Allowance Spending First Half of 2014:

|

Theresa's $300 Allowance:

1/31/14 Index Cards for garden notes $ .69 2/9/14 Garden Expo parking $ 6.50 2/9/14 Garden Expo entrance fee for 2 $ 16.00 2/9/14 Dinner at restaurant $ 11.22 2/28/14 Lunch with co-workers $ 8.00 3/8/14 Batting to make quilt, 50% off $ 15.87 3/20/14 Chocolate milk from vending machine $ 1.50 4/4/14 More vending machine food $ 2.75 4/5/14 Lunar Calendar for 2014 $ 3.50 4/8/14 Snack $ 1.50 4/19/14 Ice cream snack $ 8.25 4/24/14 Lunch with co-workers $ 10.00 4/25/14 Garage sales $ 20.75 4/26/14 Garage sales $ 12.40 4/28/14 Spirituality book $ 6.78 5/4/14 Paint for shed $13.00 5/10/14 Used book sale $ 1.25 5/16/14 Snack $ 1.50 5/17/14 Plant sale- cooking herbs $ 8.40 5/17/14 Garage sales $13.00 TOTAL: $ 171.37

Theresa's $130 Gardening Allowance:

3/3/14 Seeds $ 9.00 3/8/14 Grow light fixture & 1 bulb $ 40.00 3/8/14 Seed tray & fertilizer, seeds $ 15.21 3/10/14 Tomato seeds $ 7.65 3/10/14 Jostaberry bare root bush $ 18.88 3/13/14 Flourescent bulb for plant light $ 8.49 3/13/14 Potting soil $ 3.49 3/29/14 Replace bulb in old plant light $ 6.39 4/19/14 Onion sets, row cover $ 19.45 4/19/14 Aluminum flashing $ 5.27 TOTAL: $ 133.93 OVERSPENT BY $ 3.93 |

Bear's $300 Allowance:

1/31/14 Britta filters (3) $ 24.00 2/9/14 Dinner at restaurant $ 11.22 3/14/14 Dinner at Chipotles $ 13.61 3/14 Unknown # of drinks penalty $ 50.00 4/19/14 Bear beads $ 1.50 4/25/14 Garage sales $ 33.50 4/26/14 Garage sales $ 12.40 5/4/14 Paint for shed $13.00 5/10/14 Library book sale $0.50 TOTAL: $ 159.03

|

5. FALL 2014 SPENDING UPDATE

We definitely starting going over our allowance limits:

6/11 Weed wacker cord for Bear $10.00

6/14 Zinnia plants $ 6.00

6/29 Used shirts for Theresa $ 8.97

Bear's June snacks $ 52.25

June used books $ 24.49

Water heater repair $ 60.00

7/21 Bear bought a dryer vent $ 8.00

8/7 Farm & Fleet- shower caulk, roof caulk, screen door closer $ 29.91

8/9 Farm & Fleet- window screen for repairs, weatherstripping, emergency water container, drinking mugs $ 53.86

8/17 Display jar to simplify bathroom $ 8.43

8/31 Frugal Muse used books $ 3.94

9/8 Grumpy Troll dinner $ 50.00

9/13 Anniversary Dinner- Outback $ 77.00

9/13 Home Depot- sunchoke fence (to keep them out of neighbor's yard), aluminum flashing $ 44.43

9/13 Farm & Fleet- 2 Emergency water containers, clothesline $ 29.08

9/13 Firebricks- for warming beds in the Winter, fence post for sunchokes $ 38.88

9/16 Theresa clothes- 4 shirts $ 72.05

9/18 Chest freezer so could have venison $393.52

10/18 Ancestry DNA test for Theresa $108

10/18 Window Pet Door for catio so they could go out in Winter $120

9/21 Bear’s cooking classes $270

TOTAL $1468.81

FROM OUR ORIGINAL LIST OF CHALLENGE EXCEPTIONS WE BOUGHT:

7/8 Car repair $1300.00

8/18 Used Couch $301.20

8/18 Truck rental to haul couch $ 30.59

6/11 Weed wacker cord for Bear $10.00

6/14 Zinnia plants $ 6.00

6/29 Used shirts for Theresa $ 8.97

Bear's June snacks $ 52.25

June used books $ 24.49

Water heater repair $ 60.00

7/21 Bear bought a dryer vent $ 8.00

8/7 Farm & Fleet- shower caulk, roof caulk, screen door closer $ 29.91

8/9 Farm & Fleet- window screen for repairs, weatherstripping, emergency water container, drinking mugs $ 53.86

8/17 Display jar to simplify bathroom $ 8.43

8/31 Frugal Muse used books $ 3.94

9/8 Grumpy Troll dinner $ 50.00

9/13 Anniversary Dinner- Outback $ 77.00

9/13 Home Depot- sunchoke fence (to keep them out of neighbor's yard), aluminum flashing $ 44.43

9/13 Farm & Fleet- 2 Emergency water containers, clothesline $ 29.08

9/13 Firebricks- for warming beds in the Winter, fence post for sunchokes $ 38.88

9/16 Theresa clothes- 4 shirts $ 72.05

9/18 Chest freezer so could have venison $393.52

10/18 Ancestry DNA test for Theresa $108

10/18 Window Pet Door for catio so they could go out in Winter $120

9/21 Bear’s cooking classes $270

TOTAL $1468.81

FROM OUR ORIGINAL LIST OF CHALLENGE EXCEPTIONS WE BOUGHT:

7/8 Car repair $1300.00

8/18 Used Couch $301.20

8/18 Truck rental to haul couch $ 30.59

6. FINAL 2014 THOUGHTS- Did We Succeed?

From Theresa:

We obviously bought a lot of stuff in 2014 and spent more than our $300 allowances. Toward the end of 2014, we fell off the wagon a bit, and started buying things we shouldn't have.

We Still Struggle with these Challenges:

I don't feel like our Buy Nothing Challenge was at all a failure. Instead I see lots of

Signs of Success:

Our Financial Situation is the Best It's Ever Been:

At the end of each year we are usually totally broke because our tax return, which is the bulk of our annual savings, has run out. But at the end of 2014, we have $3500 in savings. We can't contribute all of this to the Buy Nothing Challenge (BNC). It also has a lot to do with these factors:

I do also think, however, that these wonderful changes had a much larger impact on our finances because of the BNC. If we hadn't been focused on where our money was going, I think it would have been easy for this extra money to disappear. I often wonder why all the people who make so much more money than me also seem to feel like they don't have enough to go around. I think when you move into a higher pay bracket, you just start consuming more expensive stuff that still consumes all your money, so you still don't have a feeling of abundance. I noticed this in myself. For the first time in my life, I could buy things that cost $100-200 without breaking the bank. So I bought myself the $200 pressure canner that I had been wanting for years. I don't think this was a bad buy- it will allow us to can a much wider variety of food that will fill the pantry more, and help keep us healthy and eating at home. However, it would be easy to get carried away and buy new homesteading supplies every month, and I did a few times. When I pay all the bills and still have $500 left over from a paycheck, I feel almost drunk with the possibilities, since in the past there have been no leftovers at all. The BNC, though, has helped me keep my eye on what I really want to do with my extra money, which is to create a back up savings for a rainy day and pay off our mortgage early (our only remaining debt).

I also think that on a more metaphysical level, the BNC helped make our raises and the extra money from Bear's dad happen. We stated our intention to the universe- that we wanted to stop consuming and instead improve our finances- and the universe responded. I have a friend who tells me that the universe wants us to have abundance, but that we need to be open to accepting it and thankful when we receive it. The BNC helped me be open. Thank you, Universe.

We obviously bought a lot of stuff in 2014 and spent more than our $300 allowances. Toward the end of 2014, we fell off the wagon a bit, and started buying things we shouldn't have.

We Still Struggle with these Challenges:

- Bear started buying snacks at work and whenever he is in the car/at a convenience store, that exceed his $2.50 a week allowance. I even ate from the vending machine at my job sometimes (Yuck, what was I thinking?).

- We still struggle with wanting to eat out when we're tired or when we're in town and never got around to making enough of our own quick cooking frozen meals to use in these situations.

- We went to the used book stores a few times. (Note from Bear: This is where karma bit Bear in the butt. I bought seven games for the computer for around $50. The most expensive game wouldn't even start. I have problems reading stats on one of the games. I only had two that were usable or didn't suck bad enough that I was willing to throw them away.)

I don't feel like our Buy Nothing Challenge was at all a failure. Instead I see lots of

Signs of Success:

- We still bought a lot less than we usually buy in one year.

- Instead of having a big pile of new stuff that I need to find space for in the house, I have large piles of stuff that I plan to sell at a garage sale next Spring or on Craigslist. I am even getting rid of over a dozen garbage bags full of craft supplies, and am changing my craft closet into storage space for homesteading supplies.

- On a recent weekend trip into Madison, we asked ourselves if there were other errands we needed to run (as in stores we needed to go to while we were in town) and I realized there wasn't a thing that I felt like I had to go buy or even wanted to go buy.

- While we were in town Bear wanted to do his usual round of used bookstores and used DVD/video game stores, even though we'd already been in town since 6:30 am and bookstores would last all afternoon. I was too tired for that and was able to talk him out of going (not without a lot of grouchiness) by reminding him of the Buy Nothing Challenge. Later he went into town himself and went to all the stores, but didn't buy a thing. Afterward, he told me that the Challenge had helped. There were lots of things that he normally would have spent money on, but now he was better thinking through his purchases and asking if he really needed/wanted them.

- I don't regret any of the big purchases we made this year, such as the $300 couch, which has made great improvements in our life.

- Although we still often went grocery shopping every week, we found enough money in our budget to stock our pantry well enough that whenever we don't feel like going, we certainly have enough food in the house to skip a week or two.

Our Financial Situation is the Best It's Ever Been:

At the end of each year we are usually totally broke because our tax return, which is the bulk of our annual savings, has run out. But at the end of 2014, we have $3500 in savings. We can't contribute all of this to the Buy Nothing Challenge (BNC). It also has a lot to do with these factors:

- I got a large raise at work, and Bear got a small one.

- Bear's father gave us some very generous financial assistance that helped us pay off our credit card debt and covered our $1300 car repair.

- Because of the above we were able to use our tax return to pay off the last of my student loans. (They were $25,000, it took me 17 years to pay it off.) This frees up the $255 loan payment we were making each month to go toward other things.

I do also think, however, that these wonderful changes had a much larger impact on our finances because of the BNC. If we hadn't been focused on where our money was going, I think it would have been easy for this extra money to disappear. I often wonder why all the people who make so much more money than me also seem to feel like they don't have enough to go around. I think when you move into a higher pay bracket, you just start consuming more expensive stuff that still consumes all your money, so you still don't have a feeling of abundance. I noticed this in myself. For the first time in my life, I could buy things that cost $100-200 without breaking the bank. So I bought myself the $200 pressure canner that I had been wanting for years. I don't think this was a bad buy- it will allow us to can a much wider variety of food that will fill the pantry more, and help keep us healthy and eating at home. However, it would be easy to get carried away and buy new homesteading supplies every month, and I did a few times. When I pay all the bills and still have $500 left over from a paycheck, I feel almost drunk with the possibilities, since in the past there have been no leftovers at all. The BNC, though, has helped me keep my eye on what I really want to do with my extra money, which is to create a back up savings for a rainy day and pay off our mortgage early (our only remaining debt).

I also think that on a more metaphysical level, the BNC helped make our raises and the extra money from Bear's dad happen. We stated our intention to the universe- that we wanted to stop consuming and instead improve our finances- and the universe responded. I have a friend who tells me that the universe wants us to have abundance, but that we need to be open to accepting it and thankful when we receive it. The BNC helped me be open. Thank you, Universe.

From Bear:

Recently I have talked to some friends about the Buy Nothing Challenge (BNC) "lifestyle." Their comments include:

Here are my answers:

Nobody has really asked me why I don't buy very many clothes (maybe because I wear a uniform at work). I still have t-shirts from 15 years ago. I think the only clothes I've bought this year are two new t-shirts. I guess at home I can look how I want and save the good t-shirts for when I go out, which isn't very often. Make for a lot less laundry.

There are some other other things I liked about the Challenge. I like the fact that I had a goal for my personal savings, and I met that goal ($100/month). I feel better about myself now that my food splurges are a lot less often and cheaper.

The BNC is helping me remake my expectations. My internal struggle is to try to feel happy when I buy less. Sometimes to buy less I need to beat myself up and tell myself that what I wanted was stupid, or I don't deserve it. I am still working on actually wanting less, so I don't need to beat myself up. Society says to be a better person you have to have more. To me, if you have to have a lot more, you're greedy. There's poverty, there's a healthy zone of buying what you need and being reasonably comfortable, and then there's a level of way too much consumption/greed, which I see in corporate America. I'm trying to lower the bar for my comfort zone so that what I need and want is lower on the scale. I don't want to step into the greedy zone, even if we have more money.

Recently I have talked to some friends about the Buy Nothing Challenge (BNC) "lifestyle." Their comments include:

- Why do we "sacrifice a more comfortable way of living?"

- Why make or cook what you can buy?

- Why not have the newest style of entertainment? Why not get a newer game system with better games instead of Play Station 2 or plain X-box?

- Why have "Amish TV" (just the basic channels) when for a little more you can get hundreds of channels?

Here are my answers:

- Comfort: I am very comfortable with the way I live now. Why grow into something more complicated?

- Why we make and cook what we could buy instead:

a. The Little House on the Prairie coolness factor. I may not have the skills of Pa Ingalls, but I do have some building and survival skills. I think that's cool.

b. I know what's going in to my food and I have "control" over how good my food is for me. (Note from Theresa: and it tastes better!)

c. Our dryer broke down, but it wasn't an emergency. I can get the parts to fix it myself or have someone else do it whenever I want to instead of right now, because we built a back up laundry drying rack above our wood stove. - Our old entertainment systems:

a. Newer gaming systems are computers. I hate computers. The games may look better and possibly be better on the newer systems, but to get my money's worth I would have to play them at least 4 or 5 hours a week, and I don't have the time. Even used, the newer games are usually more expensive and I would have to find places to store them.

b. My old Wii gets me Netflix, which saves on buying DVDs. That's enough for me. - If we had more channels, I could get hooked into some TV series that I can't watch now, but in 90% of what's out there, I agree with the song that says there are 500 channels and nothing to watch. Tevo is nice, but it costs money and I have 135 things in my Netflix queue to watch already.

Nobody has really asked me why I don't buy very many clothes (maybe because I wear a uniform at work). I still have t-shirts from 15 years ago. I think the only clothes I've bought this year are two new t-shirts. I guess at home I can look how I want and save the good t-shirts for when I go out, which isn't very often. Make for a lot less laundry.

There are some other other things I liked about the Challenge. I like the fact that I had a goal for my personal savings, and I met that goal ($100/month). I feel better about myself now that my food splurges are a lot less often and cheaper.

The BNC is helping me remake my expectations. My internal struggle is to try to feel happy when I buy less. Sometimes to buy less I need to beat myself up and tell myself that what I wanted was stupid, or I don't deserve it. I am still working on actually wanting less, so I don't need to beat myself up. Society says to be a better person you have to have more. To me, if you have to have a lot more, you're greedy. There's poverty, there's a healthy zone of buying what you need and being reasonably comfortable, and then there's a level of way too much consumption/greed, which I see in corporate America. I'm trying to lower the bar for my comfort zone so that what I need and want is lower on the scale. I don't want to step into the greedy zone, even if we have more money.

Continue to our 2015 Buy Nothing Challenge.